- The December review meeting also did not change the interest rates.

- Repo rate is the rate at which RBI lends to banks, due to this reduction, loans are cheap.

RBI also did not change the repo rate this time. It has been retained at 5.15%. The RBI announced the decisions on Thursday after a three-day meeting of the Monetary Policy Committee. Apart from the repo rate, other rates have also remained stable. There was no change in interest rates even in the December meeting. Earlier, the repo rate was reduced by 1.35%, after 5 consecutive cuts.

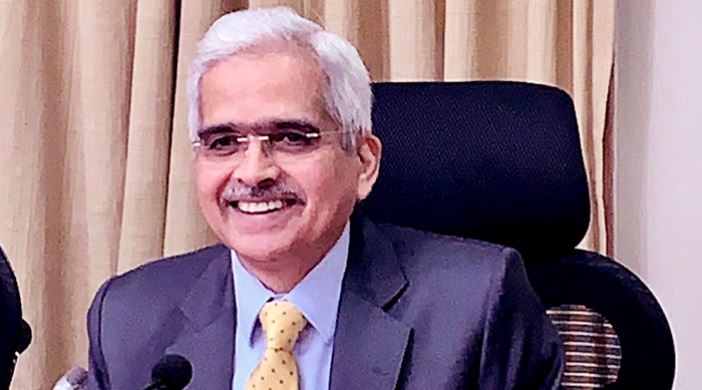

Governor @DasShaktikanta

addressing sixth bi-monthly monetary policy press conference #rbitoday #rbigovernor #rbimonetarypolicy pic.twitter.com/CjhUC2d2W0— ReserveBankOfIndia (@RBI) February 6, 2020

Also Read: PLEA FOR DEATH WARRANT TO HANG DELHI RAPE CONVICTS REACHES SC, HEARING TOMORROW

Retail inflation rate projected to be 5% to 5.4% in the first half of the next financial year

RBI has released a GDP growth forecast of 6% in the next financial year (2020-21). Estimates of retail inflation have been raised from 5% to 5.4% in the first half. Retail inflation rose to 7.35% in December due to higher food and beverage rates. This is the highest in five and a half years. The RBI takes into account the inflation rate while formulating policies. In the medium term, RBI aims to keep retail inflation at 4%. It may decrease or increase by 2%. However, in December it reached above the maximum range of 6%.

Governor, Reserve Bank of India’s Press Conference https://t.co/7AvViXwLPl

— ReserveBankOfIndia (@RBI) February 6, 2020

Accommodative outlook intact

The RBI has also maintained an approachable view of monetary policy this time. This means further reductions in the repo rate are possible.

The repo rate remains unchanged at 5.15% and maintains accomodative stance. pic.twitter.com/9dUzFwt1Q2

— ANI (@ANI) February 6, 2020

Also Read: GOVERNMENT ON OVERSEAS INDIANS, MONEY EARNED ABROAD WILL NOT BE TAXED