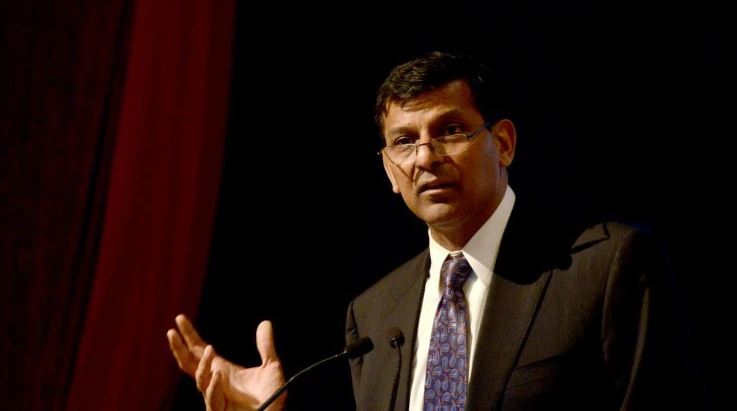

- Former RBI Governor Raghuram Rajan wrote in a magazine – signs of malaise in Indian economy

- ‘Too much centralization of power in the country, all powers near the Prime Minister’s Office’

- ‘Ideas and plans also decide a small group of people around the Prime Minister’

Former RBI Governor Raghuram Rajan has said that the country’s growth rate is slow. In a magazine, he wrote that there are signs of malaise in the Indian economy. There has been a lot of centralization of power in the country, where the Prime Minister’s Office (PMO) has all the powers. His ministers have no authority.

Raghuram Rajan said that the country’s growth rate is slow

Rajan said, “To understand what went wrong, we first need to start with a centralized system in the current government. Not only major decisions are taken in the PMO, but the ideas and plans are also decided by a small group of people around the Prime Minister. This method is suitable for the political and social agenda of the party because many people are knowledgeable about economic matters. This method is not effective in terms of economic reforms, because the people at the top do not have a systematic knowledge of the subject. They have an understanding of how the economy works at the national level rather than the states. ”

Suppressing bad news will not change the situation: Rajan

Rajan said, “To overcome the problem of economic slowdown, the Modi government must first accept the problem. Presenting every internal or external criticism as a political brand will not solve it. The habit of treating the problem as temporary must be changed. The government has to understand that the situation will not change by suppressing bad news or any inconvenient survey. India will deepen this crisis of the economy in rural areas. Any issue works only when the PMO takes care of it. When the focus of the PMO shifts to some other place, the whole process stops. ”

5 trillion dollar economy target difficult

“Construction, real estate, and infrastructure sectors are in deep trouble. Due to this, non-banking finance companies that lend them are also in trouble. Due to stranded loans of banks, the pace of giving new loans has stopped. Reviewing the wealth of non-banking financial companies, he said that corporate and domestic debt is on the rise and some parts of the financial sector are in deep trouble. ”

“Unemployment is increasing among the youth, it is creating the conditions of rebellion. Domestic traders are not investing. Stagnation in investment is the strongest indication that there is something wrong with the system. ”

Rajan emphasized on land acquisition, labor laws, stable taxes and reform of the regulatory system. Along with this, the process of declaring bankruptcy, speeding up the price of electricity, saving competition in the telecom sector, said that farmers have access to financial services.

Rajan said that the government should avoid cutting the personal income tax rates for the middle class at the moment. This will provide financial resources for schemes like ‘MNREGA’ to help the poor in rural areas.

“To achieve the goal of a $ 5 trillion economy by 2024 will require a growth rate of at least 8 to 9% every year, which seems far from reality at the moment.”

“Even if some problems are inherited, the government needs to solve them after five and a half years in power. New reforms should be introduced on a large scale. Also, the methods of controlling the administration should be changed. “